When?

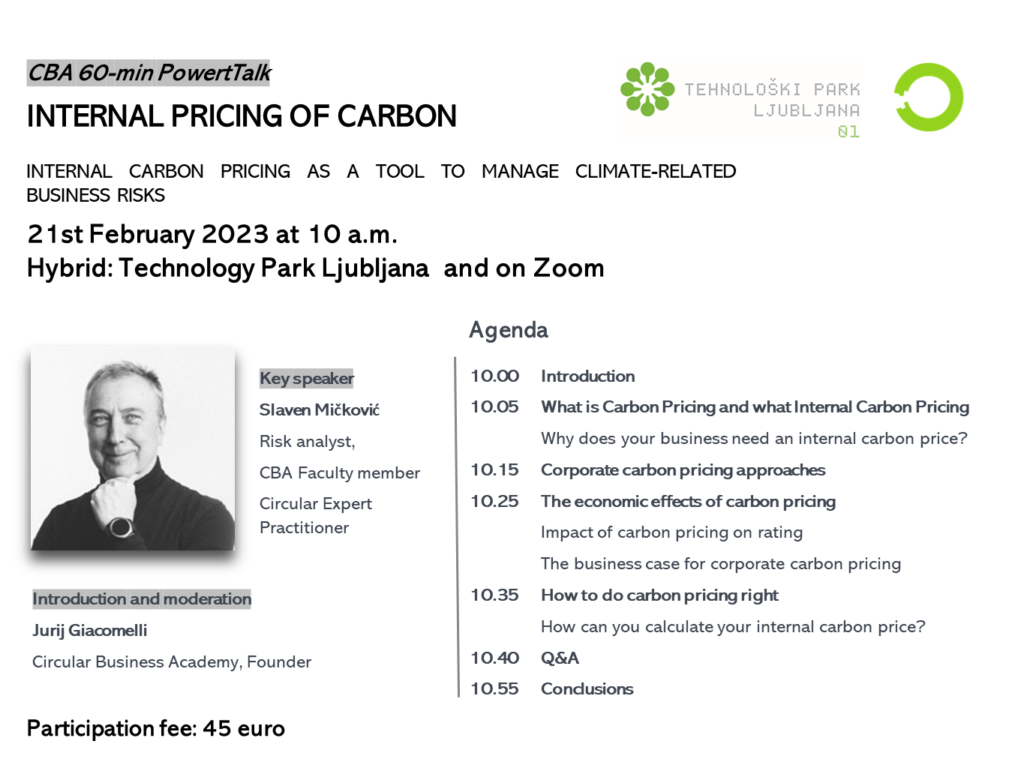

On Tuesday, 21st Feburary 2023 at 10 a.m. in hybrid format, Circular Business Academy in partnership with Technology Park Ljubljana is organising a 1-hour webinar titled Internal carbon pricing as a tool to help mitigate climate-related business risks.

Where?

Live Venue: Technology Park Ljubljana

Online: via Zoom

Participation fee: 45€ per participant

(if more participants register from the same organisation, discounts apply)

For whom?

Entrepreneurs, SME owners and directors, CEOs, CFOs, corporate risk managers, compliance managers, banking and finance sector.

Why?

The climate business risks are rising; regulation that will require reporting on ESG matters; the real possibility of CO2 emissions growing exponentially. Increasingly, companies across sectors and geographies are choosing an internal carbon price as one tool to help them reduce carbon emissions, mitigate climate-related business risks, and identify opportunities in the transition to a low-carbon economy.

Programme

10.00 Introduction

10.05 What is Carbon Pricing and what Internal Carbon Pricing

Why does your business need an internal carbon price?

10.15 Corporate carbon pricing approaches

10.25 The economic effects of carbon pricing

Impact of carbon pricing on rating

The business case for corporate carbon pricing

10.35 How to do carbon pricing right

How can you calculate your internal carbon price?

10.40 Q&A

10.55 Conclusions

Speakers

Slaven Mičković

Jurij Giacomelli

About

1. What is Carbon Pricing and what Internal Carbon Pricing? Carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for, such as damage to crops, health care costs from heat waves and droughts, and loss of property from flooding and sea level rise—and ties them to their sources through a price, usually in the form of a price on the carbon dioxide (CO2) emitted. An internal price places a monetary value on greenhouse gas emissions, which businesses can then factor into investment decisions and business operations. Companies use internal carbon pricing as a strategy to manage climate-related business risks and prepare for a transition to a low-carbon economy.

2. Why does your business need an internal carbon price? i. The signals are out there that carbon risk is real and its realities are fast approaching. Ii. In 2021, the Central Banks cautioned businesses to prepare for carbon prices to rocket compared to existing prices. iii. Additionally, the EU Governments has set out a pathway that will require EU businesses to report on their carbon-related risks.

3. Corporate carbon pricing approaches. CARBON FEE; SHADOW PRICING; IMPLICIT CARBON PRICING; HYBRID CARBON PRICING APPROACHES;

4. The economic effects of carbon pricing. Effects on consumers, companies, employees, on trade, economic growth and international competitiveness?

5. Impact of carbon pricing on rating. Integration of climate risks into credit risk modeling.

6. The business case for corporate carbon pricing. Companies use internal carbon pricing as a strategic risk management tool to inform decision-making and prepare for a carbon-constrained future. Many companies examined for this report have some form of an internal carbon price and most consider it an integral part of their corporate strategy for addressing climate change risks.

7. How to do carbon pricing right? Various organizations have published studies to help governments and businesses develop efficient and cost-effective instruments to put a price on the social costs of emissions.

8. How can you calculate your internal carbon price?